How did 100 Bendigo Banks close without anyone noticing until now?

- Dale Webster

- Jul 23, 2025

- 5 min read

Updated: Aug 21, 2025

BENDIGO Bank has hit the headlines for closing 10 branches shortly followed by an announcement it was getting rid of all of its regional agencies but there are another 90-odd Bendigo-branded banks that have been shut over the past five years it has managed to keep quiet.

Many of these were community franchises that have been disappearing in the dozens, with both regional and metropolitan areas impacted.

The closures appear linked to a review of the community bank business model revealed by former Bendigo Bank chief executive Marnie Baker under questioning during an investor briefing in 2022, according to Banking Day.

Ms Baker was reported to have described community banks as “deposit roving franchises” and a “customer aggregator” for Bendigo Bank.

“Our community partners know that models need to evolve and change as the environment changes and customer preferences change. So, yes, we are reviewing that model along with our community partners to ensure it is a sustainable model well into the future,” she said.

It will probably never be known what has been said to community bank owners behind closed doors but the result has been the loss of 34 branches since late 2019, with the heaviest cuts in 2022.

Shearwater, Sheffield and Queenstown community banks in Tasmania were sold to Bendigo Bank in 2022 resulting in the franchise agreements being cancelled and the immediate closure of the battling northern sites.

Queenstown – in the black for a decade – continued to run for another two years until Bendigo announced its closure among the group of 10 corporate sites this month.

The Queenstown bank’s last annual report as a franchise in 2021 gives a clue to the pressure being put on franchisees: “Supporting structures for Community Bank companies are facing consistent review and restructure, thereby creating an increasingly testing environment for the QDFL Board to navigate. Director fatigue has become a health and well-being issue that your community company Directors are flagging as the biggest threat we face as a business.”

While the three Tasmanian community banks were run in isolation, many of the mainland closures appear to be related to a rationalisation of networks with the aim of increasing profits by companies that operated more than one branch.

One community bank owner that ran four branches reported in 2021 that accounts had increased and lending for property was at record levels with growth across all sites.

By 2022 however, it had closed two of the branches, both of which had been named in 2021 as achieving the best lending results the company had seen in years.

There have also been takeovers; franchises sold to other franchise owners, with customers transferred and the branches closed.

All very cut-throat, or more to the point, corporate.

If community banks are starting to act like this, possibly under duress, the model is clearly moving away from the reason it was set up in the first place, which was to respond to regional Australia’s bank closure crisis.

The closure of Queenstown – which as a franchise had long been keeping its head above water while providing the only banking services to the west coast of Tasmania – shows Bendigo has become just as ruthless in leaving towns bankless as the big four.

Of the 10 corporate sites announced this month to close, five – at Queenstown, Korumburra, Yarram, Bannockburn and Malanda – are the last banks in town.

The closures have made national news but an assessment of data supplied by Bendigo Bank to the Australian Prudential Regulation Authority has revealed these are just the tip of the iceberg compared to those that have, like the community banks, mostly gone unreported over the past five years.

Along with the 33 community banks and the 10 just announced there have been at least another 42 corporate closures – possibly more – that have quietly slipped by the public’s notice since 2019.

Since 2014, 69 Bendigo Bank corporate sites and 37 community banks have been closed and one made cashless.

Bendigo has also sold four corporate sites to community companies, one of which was immediately closed.

With news breaking this week that Bendigo Bank is closing all of its 28 agencies in vulnerable regional communities that have already been decimated by closures too, pressure continues to mount on the Federal Government to officially respond to the final report from the senate inquiry into regional bank closures, tabled more than a year ago.

Prime Minister Anthony Albanese is a supporter of a government-owned bank, which the senate committee found was the only reasonable solution to a growing humanitarian crisis it heard first-hand about over the 15-month inquiry.

“I think there is a role for state-owned enterprises in competing, in keeping the private sector a bit honest”, Mr Albanese told broadcaster Neil Mitchell in 2023.

“I wouldn’t have sold the Commonwealth Bank, probably, still, going back. I think that there would have been better behaviour by the big banks had there been a public instrumentality there competing with it.”

With even community banks now turning on their customers, the time has come for Mr Albanese to stand by his words and at least agree to forming an expert panel to look at the options and costings, which was the recommendation of the tripartisan committee.

Bendigo Bank can be thanked for giving the issue the impetus it needed just as parliament resumed.

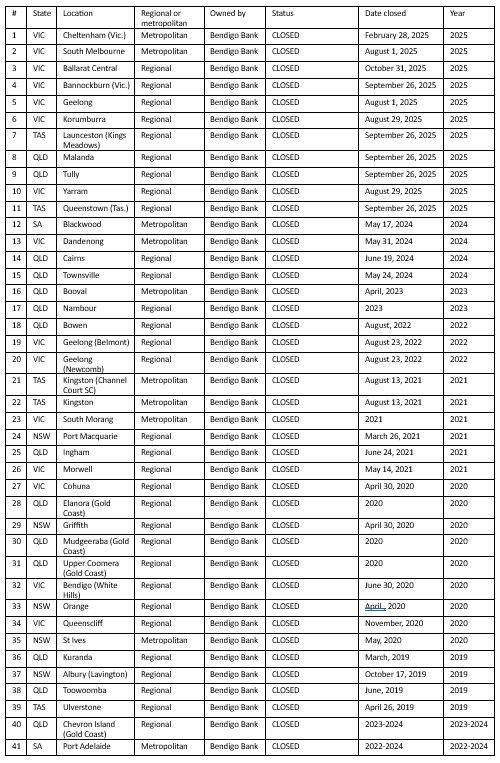

Community bank closures

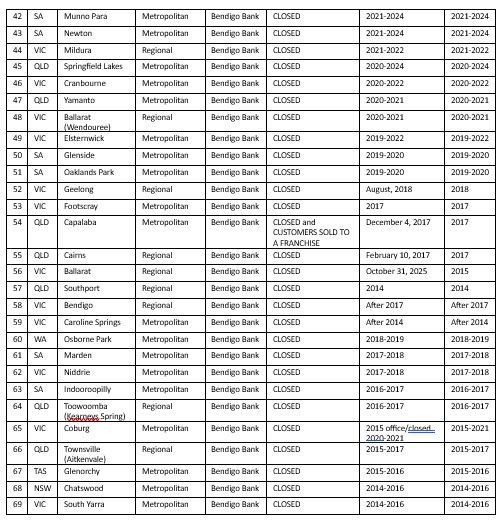

Corporate closures

Bendigo Bank agency closures

Lake Cargelligo Agency 10 October 2025

Jerilderie Agency 13 October 2025

Grenfell Agency 14 October 2025

Crookwell Agency 16 October 2025

Cowra Agency 16 October 2025

Condobolin Agency 16 October 2025

Buronga Agency 16 October 2025

Mathoura Agency 17 October 2025

Blackheath Agency 17 October 2025

Darlington Point Agency 17 October 2025

Holbrook Agency 13 October 2025

Berrigan Agency 23 October 2025

Welshpool Agency 6 October 2025

St Arnaud Agency 17 October 2025

Wedderburn Agency 21 October 2025

Wycheproof Agency 21 October 2025

Clunes Agency 21 October 2025

Alexandra Agency 22 October 2025

Boort Agency 23 October 2025

Myrtleford Agency 24 October 2025

Marysville Agency 24 October 2025

Port MacDonnell Agency 3 October 2025

Kingston Agency 10 October 2025

Cleve Agency 17 October 2025

Tumby Bay Agency 21 October 2025

Wudinna Agency 24 October 2025

Cunderdin Agency 23 October 2025

Taroom Agency 23 October 2025

The Bendigo and Adelaide Bank network - interactive map

ABOVE: Toggle for data sets using the grey box on the bottom left of the screen.

UPDATE: An urgent request for an interview with Mr Albanese was placed with the Prime Minister's office on July 25 to discuss the comments made to Neil Mitchell in 2023 and why the government has not responded to the final report from the senate inquiry into regional bank closures.

UPDATE: Jimboomba Community Bank, which was closed in 2022, has been added to the list since publication.

Stories on The Regional’s website are free to read and always will be.

If you enjoyed this article you can show your support by joining our mailing list (either by filling out the form below or sending us a message).

We'd also get very excited if you followed us on Twitter.

Comments